Research &

Publications

Driven by our academic spirit, we strive for maximum transparency about our technology and the added-value we can generate for our clients. Therefore, we regularly publish relevant use cases and background information on our projects. You may find useful insights in the context of applied risk and portfolio management and latest research.

Bitcoin mit eingebautem Airbag - Payoff Magazin Juni 2024

Artikel in Payoff: ADBI – ETP VON LEONTEQ AUF DEN ADAPTIVV DOWNSIDE CONTROL BITCOIN ETF INDEX

𝗜𝗻𝘁𝗿𝗼𝗱𝘂𝗰𝗶𝗻𝗴 𝘁𝗵𝗲 𝗔𝗱𝗮𝗽𝘁𝗶𝘃𝘃 𝗦𝗲𝗻𝘀𝗼𝗿®: 𝗬𝗼𝘂𝗿 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗔𝘂𝘁𝗼𝗽𝗶𝗹𝗼𝘁 𝗶𝗻 𝗨𝗻𝗰𝗲𝗿𝘁𝗮𝗶𝗻 𝗧𝗶𝗺𝗲𝘀

Introducing: Adaptivv Sensor®

SSI Wealth Management AG and Adaptivv enter into a partnership

Adaptivv is pleased to announce a new partnership with SSI Wealth Management AG. SSI Wealth Management was founded in 2010, employs around 20 people and manages 2 billion francs in client money.

Gehört Bitcoin 2024 in ein ausgewogenes Portfolio?

Gehört Bitcoin 2024 in ein ausgewogenes Portfolio?

Artikel im Portfolio Journal 12.2023

PRESS RELEASE - Adaptivv and Leonteq launch an Actively Managed Certificate on Bitcoin

Adaptivv and Leonteq launch an Actively Managed Certificate on Bitcoin

Launch of Adaptivv Downside Control® Bitcoin AMC at SIX Swiss Exchange

Our next product in the Adaptivv Downside Control Series is ready to launch. The Adaptivv Downside Control Bitcoin AMC will start trading on 29.11.2023 at the SIX Swiss Exchange in cooperation with Leonteq.

We are proud that our technology is now investable for every Swiss investor. The goal of the strategy is to participate in the development of the Bitcoin market but to reduce losses in times of crisis through our Adaptivv Sensor®.

Launch of Adaptivv Downside Control® Swiss ETP+ at SIX Swiss Exchange

Our next product in the Adaptivv Downside Control Series is ready to launch. The Adaptivv Downside Control Swiss ETP+ will start trading on 23.11.2023 at the SIX Swiss Exchange in cooperation with Leonteq.

We are proud that our technology is now investable for every Swiss investor. The goal of the strategy is to participate in the development of the Swiss stock market but to reduce losses in times of crisis through our Adaptivv Sensor®.

Adaptivv and Tareno AG enter into partnership

We are very excited to announce our new partnership with Tareno Ltd. Established as a company in 2000, Tareno is in the meantime one of the 15 largest independent asset managers in Switzerland with 2.5 bn CHF assets under management.

Within this cooperation framework, Adaptivv provides for Tareno customized risk management and quantitative research across all asset classes. The aim of this cooperation is to support Tareno with regular market nowcasts to control market risks in a reliable and efficient process.

Launch of Adaptivv Downside Control World ETP+ at SIX Swiss Exchange

Bell ringing ceremony at SIX

Adaptivv - Active vs. Passive June 2023

Market risk measurement and control, a comparison of passive with active risk management

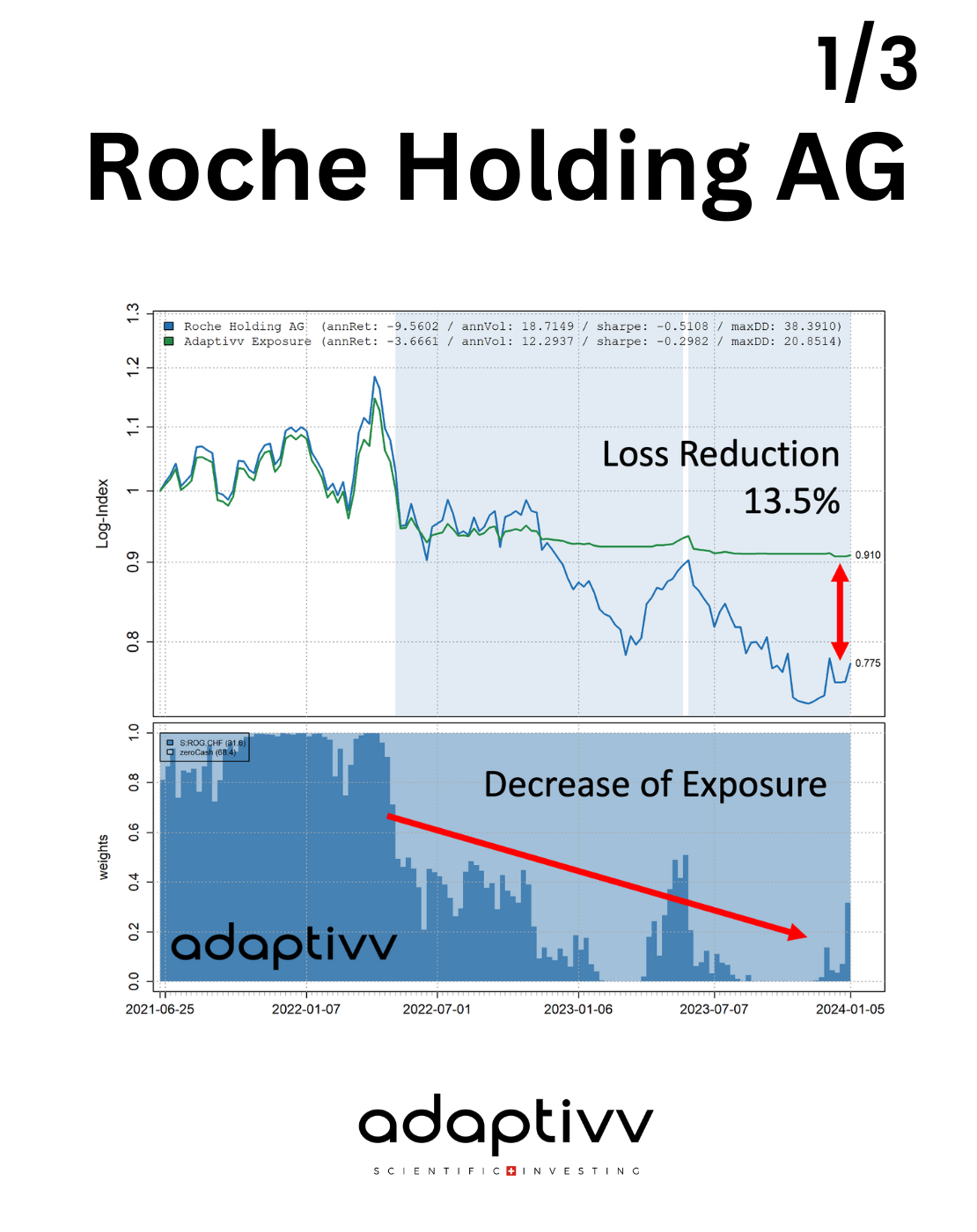

Could we have helped CS investors?

The question we got from a pension fund this morning was: Would our technology have helped a CS stock investor? The answer is yes, and very clearly so.

New Partner: Stefan Buck joins Adaptivv.

Stefan Buck joins the ETH spin-off Adaptivv (formerly OpenMetrics Solutions AG) as a new partner. The entry of the experienced derivatives specialist (Leonteq, Barclays) underlines Adaptivv's ambitions to distribute its own investment products.

The science behind the adaptivv sensor techology

Dr. Tobias Setz. Stable Portfolio Design Using Bayesian Change Point Models and Geometric Shape Factors. Doctoral Thesis ETH Zurich (2017).