There may be certain jurisdictions in which our ETPs are not available to investors. Please consult your local advisor to determine whether you are permitted to invest.

ADSIC

Adaptivv Downside Control SWISS ETP+

ISIN: CH1290280408

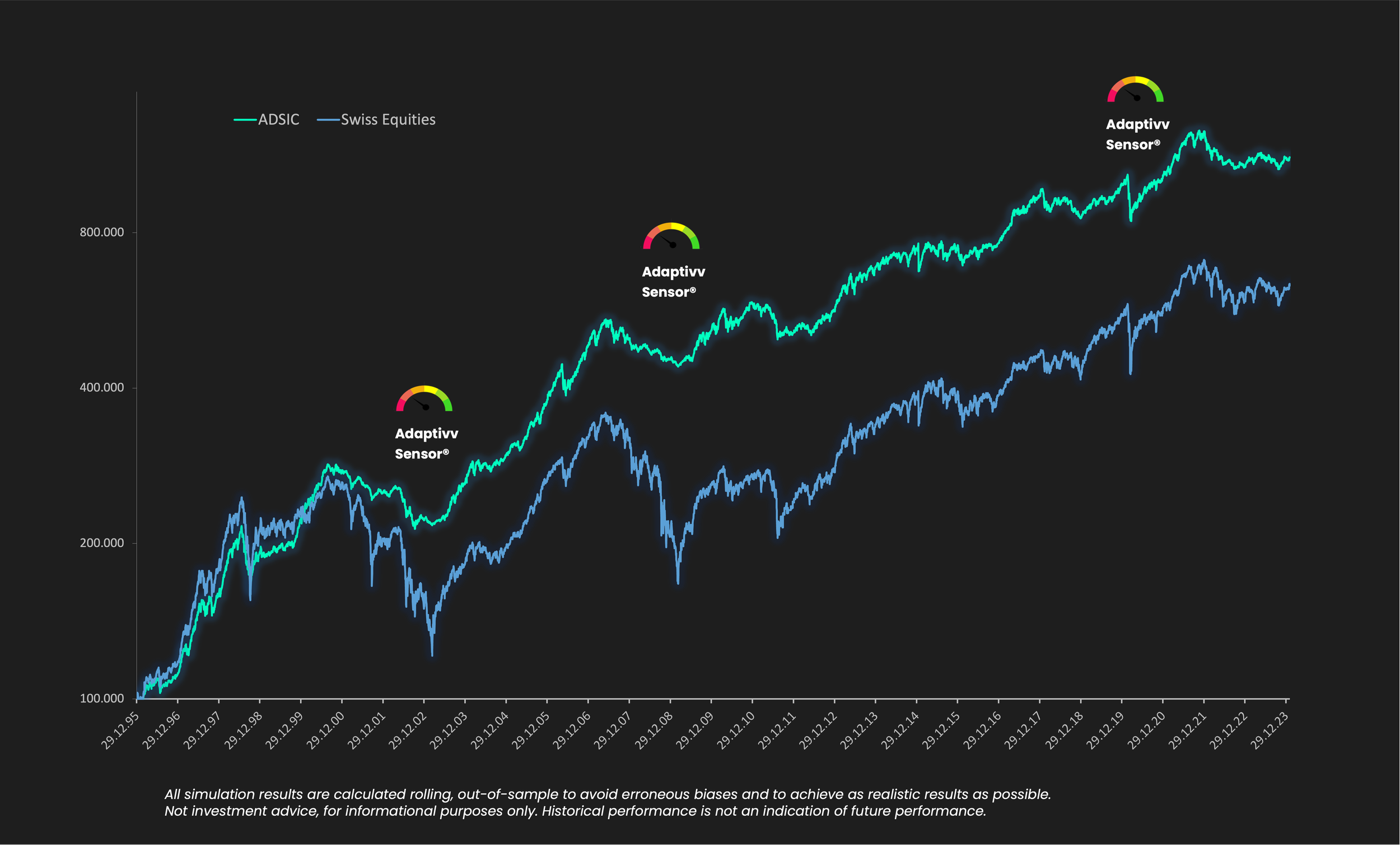

Adaptivv Downside Control Swiss ETP+ (ADSIC) offers a more balanced Swiss equity exposure with the added protection of an "airbag" for market crises, utilizing the Adaptivv Stability Sensor® technology from ETH Zurich to measure market stability. It's designed for investors looking to gain from Swiss equities while reducing major losses.

YTD Yield:

+0.42%

3 Months:

-3.35%

2024:

+2.03%

per End of April 2025

Performance since inception

+4.89%

Overview

The Adaptivv Swiss Equity ETP+ offers a scientifically-backed approach to investing in Swiss equities, featuring a built-in "airbag" via the Adaptivv Stability Sensor® for enhanced market crisis protection and dynamic exposure control. It provides a balanced investment option, fully collateralized and tradable on the SIX Swiss Exchange, ideal for investors seeking to participate in Swiss wealth creation while mitigating risks during severe market corrections.

Documents

Benefits

-

Balanced Swiss Equity Exposure

Offers a more balanced exposure to Swiss equities compared to the SPI Index, for diversified investment. The strategy invests in the 50 largest Stocks whereas the weights are more equally distributed than in the benchmark indices.

-

Market Crisis Protection

The Adaptivv Sensor® systematically measures the risk of major crashes in the equity markets and thereby controls the equity quota from 0% (for high measured risks) to 100% (for low measured risks) depending on the measured risk regime.

-

Dynamic Exposure Control

Adjusts exposure dynamically (0% to 100%) based on market stability, ensuring maximum protection for investors.

-

High Liquidity and Security

ADSIC is tradable daily on the SIX Swiss Exchange and BX Swiss, ensuring high liquidity. The ETP+ is fully collateralized, offering enhanced security to investors.

-

Proven Track Record

The Adaptivv Sensor® Technology has been operational since 2016, showcasing a strong and reliable performance history.

-

Swiss Wealth Creation

Engage in Swiss wealth creation by staying invested, even through challenging market conditions, with the Adaptivv Strategy.

| Key Information | |

|---|---|

| Asset Class | Equity/Money Market |

| Investment Type | ETP+ |

| Currency | CHF |

| Use of Income | Accumulating |

| Issue Date | 17.08.2023 |

| Maturity Date | Open-End |

| Listed | SIX Swiss Exchange PLC, Zurich, Switzerland |

| Management Fee (p.a.) | 0.75% (including issuer, index provider and index sponsor) |

| Collateral Management (p.a.) | 0.20% |

| Performance Fee | None |

| Liquidity | Daily |

| Index Sponsor | Adaptivv Financial Technologies Ltd |

| Issuer | Leonteq Securities PLC, Guernsey Branch (collateralized) |

| Collateral Agent | SIX Repo Ltd, Zurich, Switzerland |

| Index Calculation Agent | LIXX LLC |

| Offering | Public offering only in Switzerland |

| Tickers | |

|---|---|

| Valor | 129028040 |

| ISIN | CH1290280408 |

| SIX Symbol | ADSIC |

Performance

YTD Yield:

+4.66%

3 Month:

+3.69%

2023:

+4.28%

as of 23.02.2024

Dr. Tobias Setz, Partner Adaptivv

"Investing in the Swiss Market traditionally means facing significant concentration risks with the top three stocks and bearing the full downside in severe market corrections. ADWIC offers a solution for both challenges."

How to invest: A step by step guide

①

Search for a specific ETP by using its ticker symbol, ISIN or name on the bank/broker platform

②

Select the number of ETP shares you wish to purchase and specify the order type (market order, limit order, stop loss, etc.)

⓷

Review your order to ensure accuracy and confirm the trade)

⓸

After the ETP order is executed, you can track the investment's performance through your brokerage account

Available Investment Products

Adaptivv Downside Control SWISS ETP

Adaptivv Downside Control WORLD ETP

Adaptivv Downside Control ETHEREUM AMC

Adaptivv Downside Control BITCOIN ETP

Adaptivv ALL SEASON ETP+

Adaptivv Downside Control US TECH ETP

This document constitutes advertising within the meaning of article 68 of the FinSA and is intended for information only and for personal use.

The financial products in this document do not qualify as units of a collective investment scheme in the meaning of Article 7 et seqq. of the Swiss Federal Act on Collective Investment Schemes (CISA) and are therefore neither supervised by the Swiss Financial Market Supervisory Authority (FINMA) nor registered with FINMA. Investors do not benefit from the specific investor protection provided under CISA.

No action has been or will be taken to permit a public offering of the financial products or possession or distribution of any offering material in relation to the financial products in any jurisdiction, where such action for that purpose is required. The most important jurisdictions where the financial products may not be publicly distributed are EEA, UK, Hong Kong and Singapore. The financial products may not be offered or sold within the USA, or to or for the account or benefit of US persons (as defined in Regulation S).

It does not constitute a public offering, an offer to sell or a solicitation to buy any financial instruments and it is not research. It is not intended to form investment, legal or tax advice and should not be used as the basis for investment decisions. Before making an investment decision, you should obtain professional advice. Past performance is no indicator or guarantee of the future performance of a financial instrument. Individual services and products are subject to legal restrictions in certain countries. They may therefore not be offered throughout the world without restriction. All information is made without warranty to its currency, accuracy, or completeness. Adaptivv reserves the right to alter its services, products, or prices at any time without prior notice. Adaptivv rejects any and all liability for incorrect or incomplete information. No responsibility is assumed in case of unsolicited delivery. Complete or partial reproduction without the express consent of Adaptivv is not permitted.

The relevant product documentation of the financial products can be obtained directly at Adaptivv via telephone: +41 44 552 49 09 or via email: info@adaptivv.com.

© Adaptivv 2024. All rights reserved.